Ex-smokers urged to notify insurer to make big savings

Ex-smokers who have successfully quit the habit for twelve months or more are being called upon to reap the financial benefits.

One of the leading life insurance and pensions companies in Ireland, Royal London Ireland, is advising people that if they successfully quit the habit for twelve months or more, it can mean substantially reduced life insurance premiums, in some cases by up to 50pc.

Experts at Royal London Ireland say there are life insurance policyholders nationwide, who now fit the criteria of ex-smokers, that are unaware of the potential cost-savings resulting from their change of status. Compared to a non-smoker, a smoker could pay around twice as much for life insurance.

Barry McCutcheon, Protection Propositions Lead at Royal London Ireland commented,

“Ex-smokers can save thousands of Euros on their life insurance premiums. That’s because if you have life insurance in place and you’ve successfully given up smoking for more than twelve months, it’s now possible to dramatically reduce the cost of your premiums”.

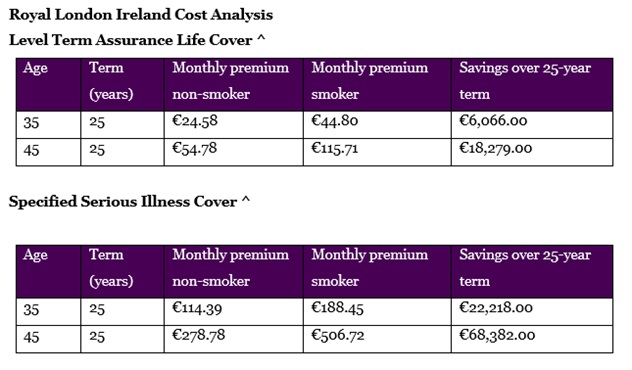

A recent cost analysis conducted by Royal London Ireland illustrates the difference between premiums paid by non-smokers and smokers.

Commenting, Mr McCutcheon said,

“Although it’s generally expected that smokers will face higher premiums when it comes to life insurance, the cumulative impact on the overall cost throughout the policy's lifetime is not always fully considered. For instance, a smoker turning 45 on their upcoming birthday will pay over €18,000 more than a non-smoker for a €300,000 Level Term Life Cover over a 25-year term. A smoker with a 25-year Specified Serious Illness policy for €300,000, who turns 45 on their next birthday, can expect to pay over €68,000 more than a non-smoker. These striking cost savings on life insurance are just another motivating factor for anyone who is planning to give up the expensive habit for good”.

As part of Budget 2024, the cost of a packet of cigarettes increased by 75c in October of last year, bringing the price of a pack of 20 cigarettes up to an eye-watering €16.75.

Mr McCutcheon commented,

“Government measures are having a positive effect on reducing the amount of people in Ireland who smoke. The most recent Healthy Ireland Survey 20232 recorded that 18pc of the population are current smokers. This marks a 5pc reduction in the number of smokers in the country since the survey was first published back in 2016, in which 23pc of people smoked. Within this cohort of people, it’s likely there are individuals unaware that they can take advantage of more affordable life insurance rates. If you are one of them, we would advise you to see if you can benefit from decreased life insurance premiums – it could put more money in your pocket.”

When it comes to being re-classified as a non-smoker on your life insurance, Royal London Ireland states that an individual must have completely abstained from all nicotine and tobacco products in the past twelve months. This abstinence requirement includes the use of e-cigarettes, and vapes, as well as nicotine replacement items such as nicotine patches, lozenges, sprays or chewing gum. Additionally, there should be a commitment to continue to abstain in the future. As well as providing some health-related information, it’s possible that your insurance provider may ask you to complete a cotinine test (smoker test). This is a simple test which involves screening a sample of saliva or urine for tobacco use. Once re-classification as a non-smoker is confirmed, Royal London Ireland will reduce your life insurance premium to reflect that of a non-smoker.

12/02/2024