Specialist

Buying a daily cup of coffee or buying your lunch instead of making it won’t be the difference between achieving financial independence or not...

Buying a daily cup of coffee or buying your lunch instead of making it won’t be the difference between achieving financial independence or not...

I was in a discussion about how much you need to retire and the conversation was centered on how much does your life cost. One of the contributors said they were in an upmarket coffee shop and were going to order a slice of cake, until they saw the price, €4.50 for a slice of cake and €3.50 for a coffee. They couldn’t bear to pay that price, so they went to the supermarket and bought a cake and had a slice of it at home. As they had a whole cake and a jar of instant, they were able to treat themselves over several days. Besides not actually saving any money by spending the same amount of money, is having multiple experiences of instant coffee and cake out of packet the same as one experience of having freshly ground coffee and freshly made cake with whipped cream served to you at your table?

Another one is people criticising those who buy their morning cup of coffee, spending €3 – €4 a day instant of using the instant in work. Those €3 add up, they say; €15 a week or €720 for a 48 week working week. Think what you could get with that!

All of that is nonsense. Buying a daily cup of coffee or buying your lunch instead of making it won’t be the difference between achieving financial independence or not. It’s the big ticket items that make a difference.

Big House

A big house means big debt. Your mortgage is the biggest expense you have every month and it is a commitment you make for most of your working lives. Governments even use mortgage repayments to keep inflation under control by increasing interest rates so you have less discretionary income.

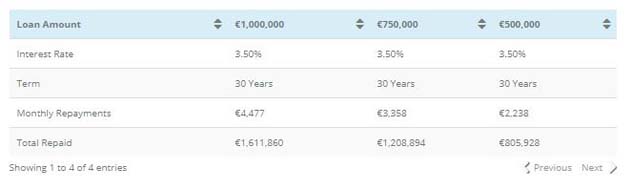

It also has a huge impact on your ability to achieve financial independence. These big purchase items are a big commitment on your finances and will cost a lot of money over your working life. The table below shows you the financial commitment required for three different mortgage amounts:

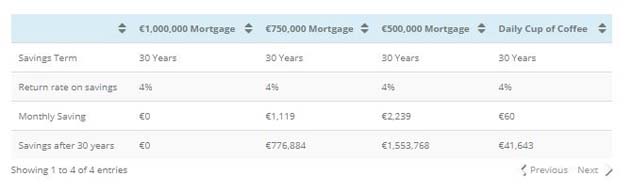

The bigger the repayments, the less money you have to save. Let’s assume that all these mortgage holders all had the same income and the smaller mortgages were able to save the difference and earn a return of 4% per annum (very achievable over 30 years) How much would they have at the end? We’ve also added in the person who gave up that daily cup of coffee as well :

Add on Lifestyle Costs

It’s not only the cost of having an expensive house that will effect your ability to create wealth and achieve financial independence. If you live in an expensive area, keeping up with the Joneses may become an issue. If all your neighbours are driving SUVs, you won’t want to drive up in your 10 year old banger. Or maybe you don’t mind but your spouse or kids do and the constant badgering moves you to buying a more expensive car. There may be private school fees to pay and the additional costs that go with that, with school trips to far flung corners of the globe.

So next time you are buying an expensive piece of cake, don’t be worrying about the effect that the price is going to have on your future ability to achieve financial independence. Enjoy the experience.

Steven Barrett is the Managing Director of Bluewater Financial Planning.