Specialist

I often hear people say that investing is just like gambling, when in fact it is the opposite. The longer that you gamble, the more likely you are to lose your money. Whereas, the longer that you invest for, the less likely you are to lose your money; you have a much greater chance of losing your money over the short term.

I often hear people say that investing is just like gambling, when in fact it is the opposite. The longer that you gamble, the more likely you are to lose your money. Whereas, the longer that you invest for, the less likely you are to lose your money; you have a much greater chance of losing your money over the short term.

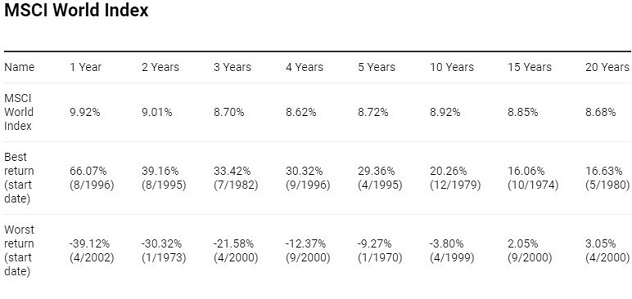

I wrote articles in August 2020 about the luckiest and unluckiest investors in the world to illustrate that time is the greatest asset you can have with investing. In those articles, I handpicked the best and worst times to invest. But people are not that lucky (or unlucky) when it comes to investing, with regular investors getting a mix of good timing as well as bad. So we looked at the returns of the MSCI World Index going back to 1970.

The top line of the graph show the average return of the index over the various investment terms and as you can see, it is pretty consistent. But what I want you to look at is the worst return. The worst 1 year return was -39.12% for someone who invested in April 2002. As you can see, the longer that you are invested for, the lower the negative return, with a lot of these periods, taking in the same crash, the dotcom crises. But if you invested for a period of 15 years, under all circumstances, your money would have generated a positive return. The 15 year investment term we are looking at here included the dotcom crises, 9/11 and the great recession. And you still came out positive at the end of it!

As well as looking at the MSCI World Index, we also looked at the other index that we use a lot of, the S&P 500. As this index is less diversified, investing in just 500 companies in one country, the risk and returns are higher. So we can see higher average returns but also bigger lows when things go badly. But again, we can see that leaving your money invested over the long term will produce positive returns.

It is very easy to get frustrated with returns, especially in the first few years of investing and be tempted to switch to another fund. Financial advisors are as guilty of this than anyone in search for positive returns to keep their clients happy. But being invested in a diversified portfolio will produce positive returns if you give it time.

Arfticle supplied by Steven Barret - M.D. at Bluewater Financial Planning