Specialist

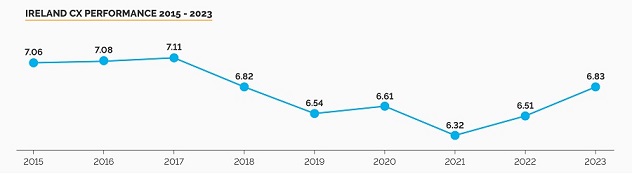

Latest annual Irish Customer Experience Report published on World CX Day shows Ireland’s overall CX score rose by 4.9% this year the biggest increase since the survey began in 2015

Latest annual Irish Customer Experience Report published on World CX Day shows Ireland’s overall CX score rose by 4.9% this year the biggest increase since the survey began in 2015

Key findings:

-

85% of brands improve their score with supermarkets, pharmacies, and health insurance companies among the leading performers

-

Survey shows customers are seeking out greater value as cost-of-living crisis bites

-

Once again, the Irish Credit Union emerges as Ireland’s undisputed CX champion – CX experts say the organisation is well placed to compete with banks on mortgages

-

The Passport Office, Aer Lingus and Power City record the biggest improvements

-

But crisis hit RTÉ plummets to last position in the list of 150 leading brands.The national broadcaster recorded the biggest fall in its score – down 17% - while it’s trust score fell by a massive 25%

-

Others to see their ranking fall significantly include Ticketmaster, NCT and Amazon

-

Entertainment & Leisure, the Public Sector and Logistics & Delivery are among the worst performing sectors

Ireland’s overall Customer Experience (CX) score rose by a record 4.9% this year with 85% of companies and organisations recording improved scores according to the latest annual CXi survey of Irish brands. The report, which was published on World CX Day, showed Ireland’s overall score was buoyed by strong performances from companies in the supermarket and retail sectors, with representatives of both making up 26 of the Top 30 rankings.

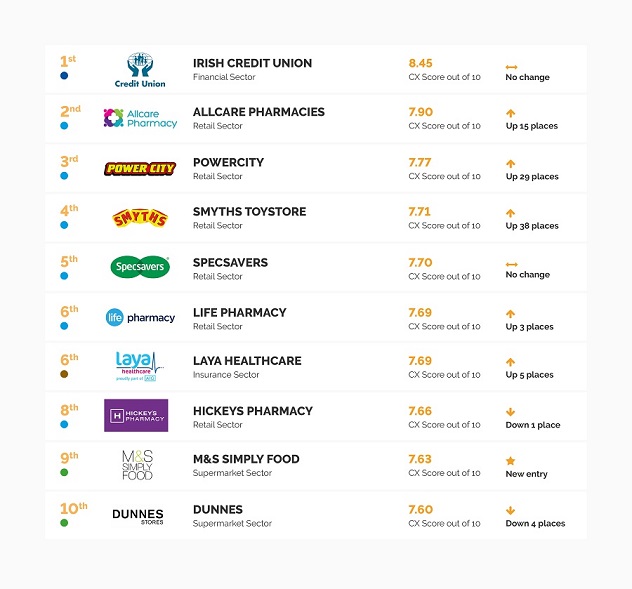

However, Ireland’s undisputed CX Champion remains the Irish Credit Union, not only claiming its table topping position for an unprecedented ninth year in a row but also improving its CX score and widening the gap between it and its rivals in the process. Pharmacies continue to lead from the front for CX in the retail sector making up 3 of the Top 10 companies with Allcare coming in second place, Life Pharmacy sixth and Hickey’s eighth. All three are part of the Uniphar Group.

Power City, which recorded the second highest score for the positive impact of their staff, breaks into the Top Ten for the first time this year, claiming third position while Smyths Toystore (4) Specsavers (5), Laya Healthcare (6), M & S Simply Food (9) and Dunnes (10) have all been in the Top Ten previously.

The highly competitive supermarket sector was the top performer overall with Aldi following M & S Simply Food and Dunnes to take eleventh place, with SuperValu (14), Tesco (16), Lidl (18) and Mace (20). Laya Healthcare was one of several companies in the health insurance market to perform well. Other include Vhi Healthcare (15) and Irish Life Health (24).

In contrast, companies, and organisations such as RTÉ, Ticketmaster and Fastway couriers which represent the Public Sector, Entertainment & Leisure and Logistics respectively were among the worst performers in the survey of almost 150 brands which was carried out by Amarách Research on behalf of The CX Company.

A winning formula

Report author and CEO of The CX Company Cathy Summers said the main reason Credit Unions are so successful at delivering customer experience excellence on a consistent basis is because they are embedded in the community and focused on driving change to meet their customers’ needs rather than just driving change to make their organisation more efficient.

She said their CX record means the larger credit unions are well placed to compete with the banks for more complex products like mortgages.

“Drawing down a mortgage for a new home is a highly emotive purchase and Credit Unions have been very good at recognising the importance of that. It is the biggest financial transaction most people will ever make so trust is key. It’s also a product which requires a lot of human intervention from the provider in tandem with the ability of the customer to upload information and communicate digitally with it. With their large branch network and their deep roots in local communities, credit unions are ideally positioned to do this.”

Some of the biggest jumpers in the 2023 CX league table include the Passport Service, Aer Lingus and Smyths Toystore. Ms Summers said the common denominator of these companies and other top performers in the supermarket and retail sectors is their ability to respond to the constantly changing needs and expectations of their customers.

Fallers

Public Sector - RTÉ – Position 150th

Customer comment “Zero Trust”

The biggest faller this year was undoubtedly RTÉ, which tumbled to last position in the table in the wake of revelations surrounding secret payments to Ryan Tubridy. The broadcaster’s overall CXi score fell 17% which is also the biggest fall recorded by any brand over the last three years. In addition, its trust score fell by a massive 25%. The public’s anger over the lack of transparency and mismanagement at the station was fully reflected in the comments of those surveyed.

The majority referred to the pay scandal with most saying it had led to a breakdown of trust between them and the station. Several said they would not be paying their TV license.

One respondent summed up the views of many; “ The RTÉ scandal has destroyed any trust or love I have for RTÉ. I really feel terrible for the hard-working staff who were treated like crap. The loss of trust in the national news provider is a major worry in this fake news age. My trust for RTÉ is gone.”

Ms Summers said the fallout from the scandal demonstrated why trust is the most important element of Customer Experience. “This year’s result is a new low for RTÉ. Trust is at the heart of every customer interaction and without trust there is no customer relationship. It is built up over time and should never be taken for granted. It’s not just about the Ryan Tubridy issue either; major scandals can often have a knock-on effect. Other respondents referenced the regular showing of repeats, issues with the RTÉ Player which is streets behind other providers and poor-quality programming. So RTÉ will have to rebuild trust by being open and transparent and then being very clear about who they are, what they stand for and how they are going to manage themselves going forward.”

“But these things can be turned around. In 2021 the Passport Service fell from a Top Twenty position to 87th. Just 18 months ago RTÉ was reporting how the Service found itself “at the centre of a perfect storm” post covid and post Brexit. This year it improved its score by over 16% and was the biggest jumper in the table, moving from 86th to 18th.”

Overall, though Public Sector organisations performed poorly with the sector coming second last of the 11 categories. Others to record a poor ranking this year include the HSE (138) and the Garda Siochana (137).

Another organisation performing a public service role which tumbled down the table to 138th was the NCT. The unavailability of tests, backlogs and long delays were the most common issues cited but respondents also complained about poor customer service and rude staff.

“NCT needs to r eview its booking and communication process from a customer perspective and to consider innovative ways of dealing with the backlogs which have mounted up. They are another organisation which needs to re-build trust with customers.”

Entertainment & Leisure – Ticketmaster – Position – 147th

Customer Comment – “Really hard to get tickets, really expensive tickets and really high charges”

Customer anger and frustration was also much in evidence with regard to Ticketmaster which recorded the second biggest drop in CX scores this year after RTÉ with a fall of 11%.

Ms Summers said the issues which people encountered trying to purchase tickets for concerts such as Taylor Swift and Coldplay included a website which crashes regularly, high ticket prices, a queueing process which is difficult to navigate, high service charges and very poor customer service.

“Trying to buy tickets with Ticketmaster is extremely frustrating for customers and demonstrates a massive gap between what they expect it should be - simple, quick and easy - and the reality which is people left hanging online for ages not even knowing if there are tickets available. While RTÉ at least has competition, the same cannot be said for Ticketmaster which operates a monopoly. Until that changes you have to wonder how much they really care about customers’ experience.”

Entertainment and Leisure was the worst performing category overall.

Logistics & Delivery – Fastway – Position 146th

Customer Comment – “On five occasions this year my deliveries have been miss-directed”

The sector with the highest number of organisations who saw their scores decline was Logistics and Delivery. The category fell four places, the biggest drop of any sector, with delivery companies like Fastway, Amazon, DHL and Just Eat all dropping their scores. The latter was the joint highest faller this year, tumbling 68 places from 60th to 128th.

Survey responses indicate that there are issues with unreliable deliveries, missed deliveries, care of the items being delivered, not being able to get to speak to a person about issues with deliveries, the timing of deliveries, incorrect orders and rude staff.

Ms Summers says this is a highly challenging sector to be in and one where customers’ expectations are very high. “The key area which all delivery companies need to address is communications around the delivery. Customers need to know when to expect their items and to be able to speak to someone who can solve problems quickly if they arise.”

Key Trends – Customers seeking value

The authors of the report say one of the key trends this year was the impact of the cost-of-living crisis on customers and the way companies are responding to that.

Michael Killeen, Chair of the CX Company said in this more cost-conscious environment customers are much more focused on value.

“Value is not what customer pay it’s what they get, and the experience given to a customer is part of this. Organisations need to think carefully about how they can deliver tangible value to customers as part of their wider CX programme. A good example of this is the increasing prominence of loyalty schemes, particularly in the supermarket and retail categories. Customers don’t want to wait to build up value, they want to see it straight away.”

While 85% of brands improved their score, many organisations have just returned to their pre-covid level of 2018. The authors say that while the 4.9% improvement in the country’s overall CX score this year – following on from a 3% improvement last year - is positive – there is still a way to go before we get back to the highest overall score of 7.11% which was recorded in 2017.

Mr Killeen said the figures showed that CX is a long-term strategy that requires ongoing focus.

“eir are a good example of a company who have remained focused on driving CX improvements, despite their historical low scores. This year it paid off as their overall CX score went up by over 22%, the biggest increase of any brand in the survey, and moved them off the bottom of the league table. This is positive and shows they are tracking in the right direction”

Movers and Shakers

In the travel category daa and Aer Lingus improved their CX scores by 17% and 15% respectively. As a result, Aer Lingus jumped 58 places from 99th last year to 41st this year, the second highest jump, while the daa improved its position by 20 places. Ryanair in contrast remained close to the bottom of the table at 144th. The authors say that the focus for the airline is much more on managing costs – which does benefit the customer - rather than improving passenger’s experience. However, feedback in the survey highlights terrible customer service, difficulties in getting compensation and refunds for delays and cancelled flights, rising prices and rude staff.

However, the star performer in this category was Shannon Airport, which achieved a hugely impressive ranking of 20 on its first year in the survey. Mr Killeen said the airport deserved great praise for its focus on improving the passenger experience.

The Financial Sector was the most improved sector this year, moving up three places to third out of eleven sectors. The authors say part of the reason for this is the excellent performance of the Credit Union, relatively strong performances from An Post Money, Permanent TSB, the EBS and Revolut and the departure of historically poor performers Ulster Bank and KBC. While AIB saw its score improve the bank remains the back marker of the category at 117th.

While it may have been anticipated that energy companies would face a backlash due to the dramatic rise in electricity costs, their fall – by 10 places on average – wasn’t as much as anticipated. The exception was Energia. The company has been the biggest faller over the last three years falling 64 places, from 69th to 133rd.

You can read and download the full report at www.thecxcompany.com