Legal

First time buyers will welcome the news that the Help to Buy scheme (the “HTB”) was extended for a further two years to 31 December 2021 in Budget 2020.

First time buyers will welcome the news that the Help to Buy scheme (the “HTB”) was extended for a further two years to 31 December 2021 in Budget 2020.

The HBT is a tax refund of up to €20,000 which can be used towards the purchase price of a new home with a value of up to €500,000. The HTB had been due to be discontinued at the end of 2019.

How the Scheme Works

The scheme operates by providing a rebate of up to €20,000 of Income Tax and Deposit Interest Retention Tax (DIRT) paid by the first time buyers in the four years prior the purchase or new build.

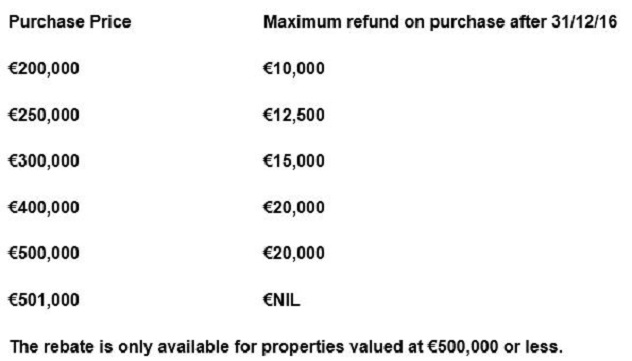

The amount that can be claimed is the lesser of €20,000 or 5 % of the purchase price of the property or market value of the new build when completed up to a maximum of €500,000 as follows:-

The maximum payment is €20,000 per property and applies regardless of how many people enter into a contract to buy a house. Payment of the rebate is made either directly to the developer (in the case of first time purchased properties) or to a bank account held with a specified qualifying lender in the case of self-built properties.

Retrospective applications are only available in limited situations – see below. Generally in order to qualify for the HTB you must not yet have completed the purchase/ construction of your new home.

Only newly built dwellings (apartments, houses, etc) and self-builds are included in the scheme. Conversions and restorations of old or derelict homes do not qualify, but conversion of a non-domestic building for residential use may qualify.

It is a requirement of the scheme that a loan with a “qualifying lender” of at least 70% of the market value of the property is taken out. Therefore cash purchasers and those with a loan to value ratio of less than 70% are excluded from this scheme.

If the property is a ‘first time purchased’ property, in order to qualify the developer or contractor must be on the Revenue’s list of approved developers and contractors. In the case of self-builds, Revenue approval of the contractor is not required.

Who can make a claim?

To claim HTB, you must:

-

be a first-time buyer;

-

buy or build a new property between 19 July 2016 and 31 December 2021;

-

live in the property as your main home for five years after you buy or build it; and

-

be tax compliant, if you are self-assessed you must also have tax clearance.

Retrospective claims are only granted where a contract for sale was executed between 19 July 2016 and 31 December 2016 (in the case of newly purchased property) or the first part of a qualifying loan was drawn down during that time in the case of self-builds.

To qualify, one must not have previously bought or built a house or apartment, either on his/her own or jointly with any other person. If a claimant is buying or building the new property with other people, they must also be first-time buyers.

The relevant section of the Help to Buy Legislation defines a first time purchaser “as an individual who, at the time of a claim…… has not, either individually or jointly with any other person, previously purchased or previously built, directly or indirectly, on his or her own behalf a dwelling”. Therefore, a person who has acquired property by way of an inheritance qualifies as a ‘first time purchaser’ under the rules of this scheme.

As stated above, the value of the dwelling must not be greater than €500,000.

Registration

First of all, you need to register for the scheme with the Revenue Online System (ROS). You will need your P60 and your driver’s license number to complete registration and time especially if you have not filed a Form 12 (for PAYE tax payers) or a Form 11 (for self-assessed individuals) for previous years. A Step-by-Step guide on applying and completing form 12s is available here and to self-assessment is here.

If you are tax compliant, your application will be approved and you will be provided with an application number/ an HTB number and a summary of the maximum amount you can claim. You will also be given an access code separately through MyEnquiries. If not, you will not be eligible to apply for the HTB.

Keep a safe note of both of these codes as you will need to provide them to your lender (in the case of a self-build) and your solicitor (where you are purchasing the property). Your contractor or solicitor will require this information to verify what you have submitted.

Claim

After you have registered for the HTB as set out above, in order to claim the refund you will need to upload the following on to the HTB section of the Revenue Online System (ROS):-

-

Evidence of your mortgage (this could be the first two pages of your letter of offer);

-

A copy of the signed contract between you and the vendor OR proof of drawdown of the first tranche of the mortgage if the property is a ‘self-build’;

-

The contractor (in the case of a ‘new purchase’) or your solicitor (in the case of a ‘self-build’) will then be required to verify the details you submitted through the ROS system before the rebate issues.

Who receives the rebate?

In the case of retrospective applications (please see above) the rebate is paid directly to the claimant.

In the case of first time purchaser, the rebate is paid to the contractor and considered a reduction of the sale price on the completion of the sale. In the case of self-builds, the rebate will be paid to a bank account held with the particular qualifying lender.

Clawback

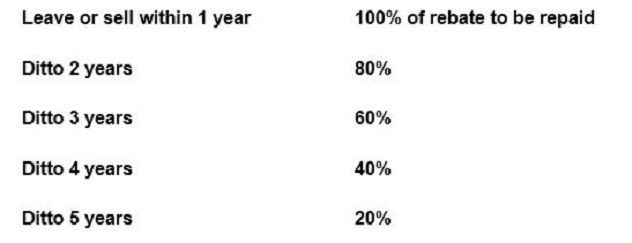

The property, when purchased must be occupied by the first time buyer or at least one of them in the case of multiple buyers for a period of five years from the date the property is habitable – otherwise some or all of the rebate will have to be repaid. The rebate is as follows:-

Summary

The HTB incentive is an extremely attractive one for First Time Buyers of Residential Property and should be availed of where possible. In view of the many actions required by both purchaser and solicitor and/or contractor prior to the issue of the rebate under the HTB, purchasers are advised to start the registration and claims process as early as possible to avoid delays when buying their new home.

If you would like to further information in relation to any aspect of this article please contact deirdre@amoryssolicitors.com, tel 01 213 59 40 or your usual contact at Amorys.